The City of Hermantown does not currently qualify for Local Government Aid from the state of Minnesota. This makes leveraging sales tax an essential asset in delivering quality services across the community.

In November of 2022, Hermantown voters cast their ballots to determine if a 1/2 percent increase in the sales tax is the desired way to fund the Community Recreation Initiative. Voters passed all three questions by significant margins, which will move the City’s portion of Hermantown’s overall sales tax up to 1.5% in 2023.

The Community Recreation Initiative is a trio of projects aimed at improving health outcomes in our region by increasing recreation opportunities across the spectrum of interests, ages, and abilities.

As part of that initiative, the City of Hermantown commissioned a sales tax study to be performed by the University of Minnesota – Extension Center for Community Vitality. That full report can be found on the right.

Why such a high number of non-residents paying sales tax in Hermantown?

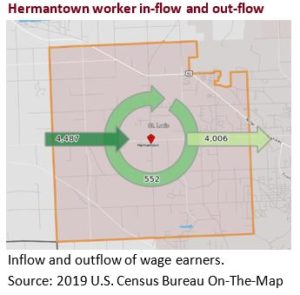

Several factors and features of Hermantown’s economy lead to this alignment, but two factors are most prevalent.

- Hermantown has a large concentration of retail, especially for its population size. The City is a major hub for retail goods in the greater Twin Ports metro area.

- Hermantown has a large proportion of its residents that leave for work. In this dynamic, commuters often shop for goods and services near where they work, and those commuting into Hermantown purchase in the City.

In fact, the impact of these two factors has pushed the percentage of sales closer to 80% in recent years.

How much sales tax does Hermantown collect?

Sales tax has increased in Hermantown consistently as the population as more retailers and businesses have chosen to make the City their hometown. Hermantown even saw an increase in overall sales tax during the challenging months of the COVID-19 pandemic.

Sales Tax FAQs

What is the sales tax in Hermantown?

The City of Hermantown will have a 1.5% Sales and Use Tax beginning April 1, 2023. Currently, Minnesota has a state sales tax of 6.875%, and there is also a 0.5% sales tax associated with St. Louis County. This leaves a total sales tax of 8.875% to be charged in the city limits of Hermantown.

Local sales tax applies to retail sales made and taxable services provided within the local taxing area. The tax applies to the same items that are taxed by the Minnesota sales and use tax law.

Who is required to collect sales tax?

All retailers who are registered to collect Minnesota sales tax and are doing business in an area with a local tax must be registered with the Minnesota Department of Revenue to collect the local tax. This includes sellers from outside of Hermantown who:

- Have an office, distribution, sales, sample, warehouse location, or another place of business in the city limits of Hermantown either directly or by a subsidiary;

- Have a representative, agent, salesperson, canvasser, or solicitor in the city limits of Hermantown, on either a permanent or temporary basis, who operates under the authority of the retailer or its subsidiary for any purpose, such as repairing, selling, installing, or soliciting orders for the retailer’s goods or services or leasing tangible personal property in the city limits of Hermantown;

- Ship or deliver tangible personal property in the city limits of Hermantown; or

- Perform taxable services in the city limits of Hermantown.

A local tax of 1.0% applies to sales made or services performed in the city limits of Hermantown only. The addresses in the City of Hermantown have one of 4 zip codes (55810, 55811, 55814, and 55701). The City of Hermantown does not have its own zip code. To determine the correct sales tax, please use your 9-digit zip code. Retailers are required to use the 9 digits to calculate their sales tax rate correctly.

Review your invoices to ensure that you have not been overcharged.

Additional information on calculating and paying the Hermantown 1.0% sales and use tax can be found on the Minnesota Department of Revenues website at www.taxes.state.mn.us or call the City of Hermantown administrative office 218-729-3600.

What does Hermantown's sales tax pay for?

The City’s sales tax pays the debt service for the construction and expansion of the City’s sewer trunkline, the Gov’t Services Building, and the Essentia Wellness Center.

In 2022, Hermantown voters decided to fund the Community Recreation Initiative with an additional half percent increase to the City’s sales tax. These election results move the City’s sales tax to 1.5% beginning April 1, 2023.

What is the impact to residents of the new the sales tax increase?

Based on analysis from the University of Minnesota, the voter-approved increase of a half percent – which is set to begin on April 1, 2023 – will, on average, be an additional $33.44 paid in sales tax over the course of a year.